BRICS Expands! Bye Bye US Dollar?

September 02, 2023

To establish themselves on the world economic scene, six more nations are set to join the BRICS. Let’s take a look at the latest expansion plans, a mutual currency and what this means for the US dollar.

By Stacey Drury

BRICS Expands in January 2024

The decision to expand the BRICS, the economic association of Brazil, Russia, India, China, and South Africa, was taken at the 15th BRICS summit, which was held in South Africa. The new members of the bloc will consist of Argentina, a developing nation, Egypt, the second-largest economy in Africa, Ethiopia, one of the fastest-growing economies in the area, and the oil superpowers Iran, Saudi Arabia, and the United Arab Emirates in January 2024. What features do they share? The only surefire response is that all six submitted membership applications.

BRICS, who lacked a defined mission and had numerous obstacles while collaborating with one another, have recently begun hiring. They also haven't finished yet. According to South Africa, which hosted the 2023 summit, more than 40 nations aspire to join the bloc, including the recently recruited members.

Brazil's President Luiz Inacio Lula da Silva, China's President Xi Jinping, South Africa's President Cyril Ramaphosa, India's Prime Minister Narendra Modi and Russia's Foreign Minister Sergey Lavrov pose during the BRICS summit in Johannesburg, South Africa August 22, 2023 [Russian Foreign Ministry/Reuters]

"The sanctions against Russia and China over the last 18 months have acted as a catalyst," said Christopher Weafer, CEO of the business consulting firm Macro-Advisory Ltd. Moscow and Beijing are attempting to reduce their over-reliance on Western economies because they have seen what happens when they are penalised.

The assembly of BRICS hasn't had much of an impact on global trade, but they did establish the New Development Bank, a cooperatively held development bank. However, they were unable to establish themselves as a heavyweight champion on the international economic stage due to a lack of apparent purpose and coordination but real variances in political interests, production standards, and currencies.

G7 and BRICS

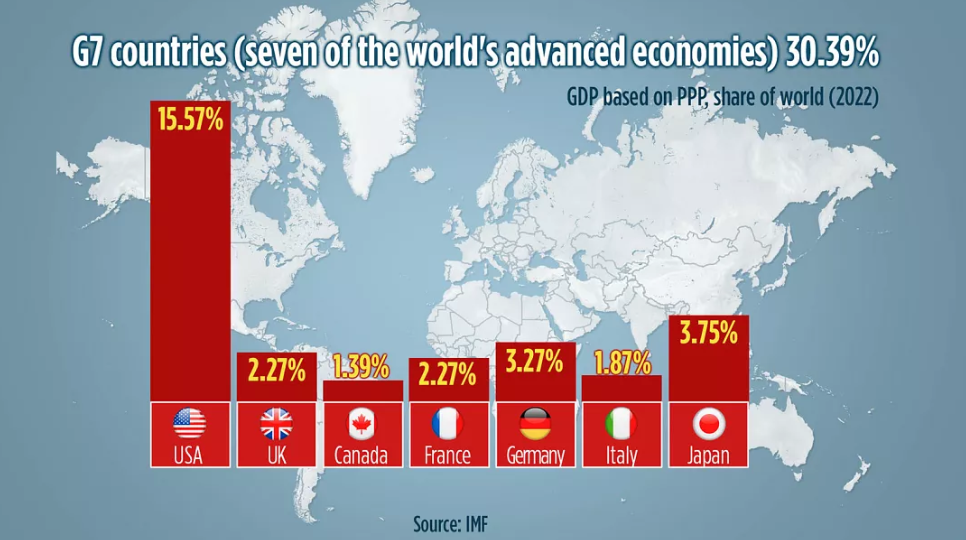

It may be said that the G7 countries, which include Canada, France, Germany, Italy, Japan, the US, and the UK, are the seven greatest advanced economies in terms of GDP, were dismissive of some of the group's objectives and interests. Geopolitics, however, started affecting economic ties more and more recently.

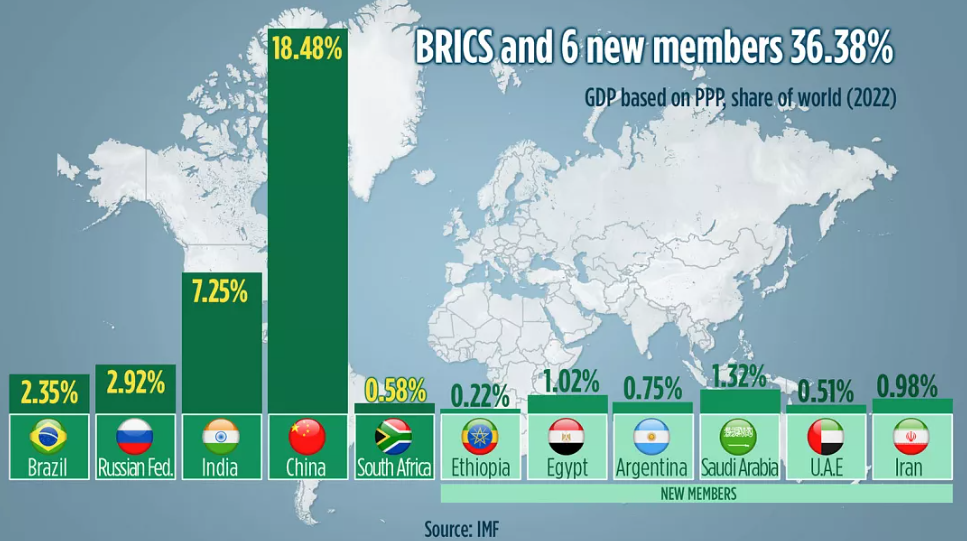

Approximately 42% of the world's population and more than $27 trillion in total gross domestic product are represented by the bloc's current members. It is estimated that the enlarged group will make up $30.8 trillion of the global GDP, based on the IMF's 2022 GDP figures, which represent 46.5% of the world's population.

The balance of power is substantially different when looking at GDP based on purchasing power parity, or PPP (% of global GDP based upon a common basket of commodities that represents the actual purchasing power). In sum, the extended BRICS now surpasses the G7 in terms of its proportion of global GDP at more than 36% on a PPP basis.

The new alliance is undoubtedly difficult to ignore given that its members produce 45% of the world's oil, have sizable iron ore, coal, and bauxite industries, and play a crucial role in global agriculture.

Because of this, developed countries, usually the G7, rely heavily on commerce with them as well as coordination on topics like climate change and environmental concerns.

The new alliance is undoubtedly difficult to ignore given that its members produce 45% of the world's oil, have sizable iron ore, coal, and bauxite industries, and play a crucial role in global agriculture. Because of this, developed countries, usually the G7, rely heavily on business with them as well as coordination on topics like climate change and environmental concerns.

Technology, investment, and trade will all be significant topics of discussion, but bridging the gap between the interests of the largest economies and the BRICS nations on environmental issues and establishing priorities may be one of the key talking points moving forward.

Common Currency

BRICS developing a mechanism to use a common currency is one of the frequently asked questions in relation to its future plans. The closest comparison of this would be the Eurozone which took decades to establish the currency, and at the time it was a bloc of physically less varied geographical nations with less political differences or challenges.

In order to lessen their reliance on changes in the dollar exchange rate, the president of Brazil called on the BRICS countries to establish a single currency for trade and investment. He argues against requiring countries that don't use the dollar to conduct business using it.

India's foreign minister stated that "there is no idea of a BRICS currency" in July. Prior to leaving for the conference, its foreign secretary stated that increasing trade in local currencies would be explored.

Vladimir Putin, the president of Russia, announced that the meeting, which he joined via video link, will discuss moving trade away from the dollar and towards national currencies.

China has not responded to the concept. At the conference, President Xi Jinping advocated for "the reform of the international financial and monetary system".

In the case of a shared currency, there is much to discuss and although an important aspiration of BRICS it could be a long time before we see it and possibly a little far-fetched in reality.

Is the US Dollar at Risk?

The dollar dramatically surged last year as the Federal Reserve boosted interest rates and Russia invaded Ukraine, increasing the cost of dollar debt and numerous imports. Leaders of the BRICS nations have stated that they wish to use their national currencies more frequently instead of the dollar.

The dollar continues to rule international trade. Almost 90% of all foreign exchange transactions worldwide have it on one side, according to data from the Bank for International Settlements.

De-dollarization would require several exporters, importers, borrowers, lenders, and currency traders to individually elect to utilise alternative currencies on a global scale and we are very far from that at the moment.

To conclude

With the recent expansion, more in-depth discussions surrounding the possibility of trading using other currencies than the US dollar and a possible mutual currency on the cards there will be lots of developments coming from BRICS and we will keep you updated every step of the way.

Education: Join the P8FX academy for a deeper insight and analysis of the topics raised in this article. If you would like to learn more about trading and investing visit www.p8fxtrading.com where you can find more information, reviews, and articles.

Disclosure: This article expresses our own opinions and views. We have no business relationship with any company whose stock is mentioned in this article. Your capital is at risk, seek financial advice.