The Global Shift: BRICS Vs US Dollar

April 24, 2023

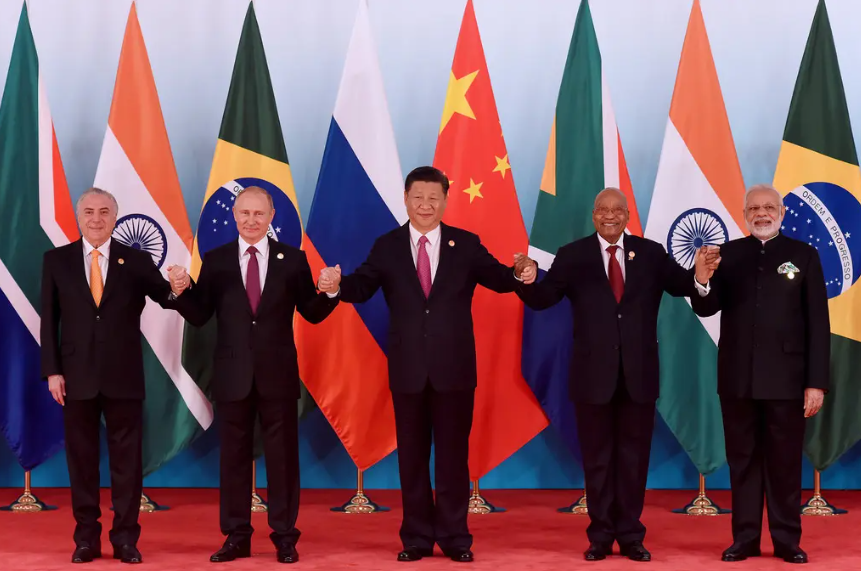

The US dollar has long been the world's preeminent reserve currency and the primary means of international financial transactions. However, the rise of the BRICS countries (Brazil, Russia, India, China, and South Africa) has recently been challenging the US dollar's dominance, leading to speculation that the US dollar could eventually be displaced by a new world currency. This article will explore how BRICS came about, if it will expand to other nations and how the dollar could be dethroned as the world's financial powerhouse.

By Stacey Drury

What is BRICS?

Brazil, Russia, India, China, and South Africa are together referred to as BRICS. The acronym BRIC (without South Africa) was created in 2001 by Goldman Sachs economist Jim O'Neill, who predicted that by 2050, the four BRIC economies would take control of the world economy. In 2010, South Africa was added to the list.

Source: Tutwa Consulting Group

Due to low labour costs, favourable demographics, and an abundance of natural resources, Brazil, Russia, India, China, and South Africa have consistently been among the nations with the fastest-expanding emerging market economies in the world.

The label's detractors claimed that the nations were too different to be grouped in this way and that it was merely a Goldman Sachs marketing gimmick. However, what may have begun as a marketing gimmick to entice investors has developed into a forum for intergovernmental collaboration akin to the G7.

The G7 was established in 1975 as an "informal forum" of the heads of state from the seven most developed nations. Along with the EU (non-enumerated member), members include Germany, France, the United Kingdom, Italy, Japan, Canada, and the United States.

Just recently, when buying power parity was taken into consideration, the BRICS nations surpassed the G7 nations in terms of world GDP with a present contribution of 31.5% to the global GDP, ahead of the G7's 30.7%.

The US dollar’s rise to dominance

Over the course of the 20th century, the U.S. dollar was increasingly viewed as the world's main reserve currency, officially replacing the British pound sterling. This period saw two World Wars, the Great Depression and the decline of the British Empire, and it also coincided with America becoming the leading global economy and exporter. The transition from the pound to the dollar as the primary international currency was a gradual process that spanned several decades.

Since the end of World War II, the dollar has held its place as the world's leading currency, being involved in approximately 90% of all yearly currency transactions as reported by the Bank of International Settlements, despite the numerous economic and geopolitical events that have occurred over the past few decades.

Photo by Olia Danilevich

The dollar has had a strong position in the world ever since 1944 with the US having an excessive amount of influence over foreign economies. In addition, the US has often used sanctions as a tool to further its foreign policy objectives.

The benefits that come with being the “King of Currency”

The U.S. economy reaps a number of advantages thanks to the dollar's status as the preeminent reserve currency. The strong demand for dollars and dollar-backed securities, such as Treasury bonds, drives down interest rates, which benefits the U.S. government, businesses, and consumers.

Additionally, the dollar's position on the world stage makes it more affordable to purchase imports, reduces the fees associated with transactions, and provides a buffer against fluctuations in exchange rates that may otherwise affect borrowers whose loans are denominated in foreign currency.

Despite the potential benefits of global trade, there are some downsides for U.S. exporters. When imports are cheaper than domestic products, overseas rivals can easily outcompete American companies. This results in a trade deficit, meaning the U.S. imports more than it exports, making it difficult to balance. The last recorded U.S. trade surplus occurred in 1975, according to the Commerce Department.

Start of the US Dollar demise?

The BRICS countries are moving quickly towards the financial system's demise, which is currently controlled by the US dollar. Bypassing the U.S. dollar is the first stage, and creating a new currency to settle international trading is the second. The second stage might be implemented following the BRICS summit in August 2023, while the first step is already in use.

Russia declared that it will settle commerce with nations in Asia, Africa, and Latin America using the Chinese Yuan. Yuan was used by China and France to conclude the LNG gas deal, putting an end to the dependency on the dollar in energy trades.

As a result, the BRICS are currently successful in their efforts to do away with the US currency and settle all international trade in local currencies. However, the dollar may experience a big decline in demand if the alliance nations decide to use a common currency to settle international trade at the forthcoming meeting in August.

Photo by Ken Ishii

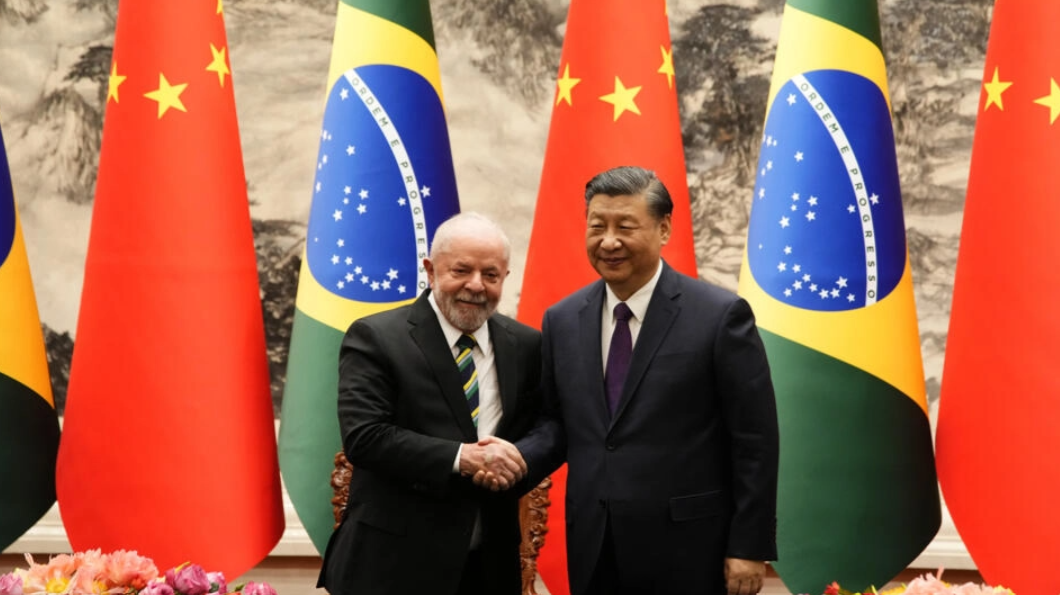

Beijing and Brazil have recently entered a landmark agreement to trade in their respective currencies, cutting out the US dollar as an intermediary. To further strengthen their cooperation, both countries are intending to expand their collaboration on food and mineral resources. This agreement will allow them to engage in large-scale trade and financial transactions, exchanging the Chinese RMB Yuan for the Brazilian Real and vice versa, without having to resort to the US dollar for settlements.

If the BRICS nations completely abandon the U.S. dollar for international transactions, it might lose some of its strength. Numerous other nations might eventually follow suit and sever ties to the USD.

The evolution of BRICS

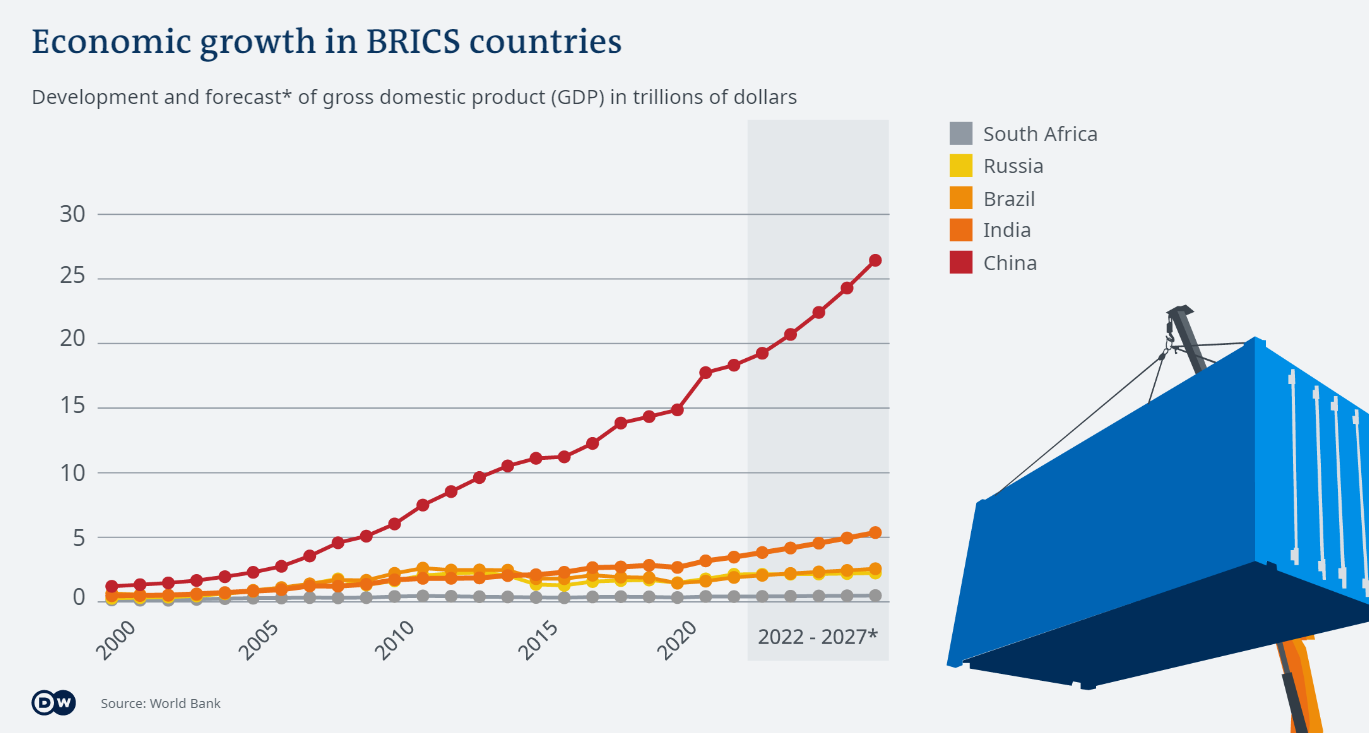

The foundational illusions upon which the BRICS group was created have little bearing on the most recent economic developments in BRICS member states. Only China has shown consistent and significant growth among the five countries since that time.

Brazil, South Africa, and Russia's economies all experienced economic stagnation as China's gross domestic product increased from $6 trillion in 2010 to approximately $18 trillion in 2021. India's GDP increased from $1.7 trillion to $3.1 trillion.

What’s next for BRICS?

The Russian-Ukrainian war's impact on global geopolitics has played some part in the possible expansion of BRICS with economically significant nations starting to express interest in the effort. Argentina, the United Arab Emirates, Mexico, Algeria, and Saudi Arabia are a few who want to be involved.

The potential of BRICS to increase its membership base while maintaining its existing growth represents one of the biggest opportunities—and challenges—it now faces. It will be crucial to support new members in maintaining their political and economic independence. Are they ready to do so?

The 15th BRICS summit is scheduled to be held in Durban, South Africa in late August this year with the discussions around producing a shared currency at the top of the conversation. There have been no specifics mentioned in terms of what type of currency should be used, be it a digital ruble, rupee, or yuan, but what it must do, is it must abide by the laws of their respective countries.

Something else to consider is that South Africa is obligated under both international and domestic law to arrest Putin and hand him over to the International Criminal Court if he decides to travel to South Africa for the 15th BRICS Summit in Durban from 22 to 24 August 2023. How will this impact the future of BRICS? Only time will tell.

Either way, we will be back with updates on this topic as they arise!

Education: Join the P8FX academy for a deeper insight and analysis of the topics raised in this article. If you would like to learn more about trading and investing visit www.p8fxtrading.com where you can find more information, reviews, and articles.

Disclosure: This article expresses our own opinions and views. We have no business relationship with any company whose stock is mentioned in this article. Your capital is at risk, seek financial advice.